The Trump $100,000 H-1B Fee Act: What It Could Mean for Seattle’s Housing Market

- Matt Miner,

- September 30, 2025

Seattle’s housing market has always been closely tied to the city’s economic engine — tech. From Amazon to Microsoft to biotech startups and research labs, our city thrives on a steady inflow of high-skilled workers. Many of those workers come here on H-1B visas.

With the passage of the Trump $100,000 H-1B Fee Act, the rules of the game just changed. Under this law, any company sponsoring a new H-1B visa must now pay a one-time fee of $100,000 per worker. Renewals for existing visa holders are unaffected, but this new upfront cost could dramatically reshape how many fresh international hires make it to Seattle.

So, what does that mean for our housing market over the next five years? Let’s break it down.

In the immediate future, don’t expect Seattle’s home prices or rents to suddenly tumble because of this policy. Interest rates, available inventory, and local demand are still the main drivers of today’s housing market. Most current H-1B workers aren’t affected, and the tech sector is still moving forward with existing teams.

Think of this as a “lagging indicator” — the impacts won’t really show up until hiring pipelines adjust.

Seattle has long relied on a steady inflow of new international workers to fuel its high-end rental and for-sale housing markets. With a six-figure fee attached to every new H-1B sponsorship, fewer of those households may relocate here.

Luxury condos and high-end rentals could see softer demand, especially in neighborhoods close to major tech hubs like South Lake Union, Bellevue, and Redmond.

Developers and landlords who’ve banked on strong international inflows may need to rethink absorption timelines and pricing strategies.

This doesn’t mean demand disappears — just that it may grow at a slower pace than we’re used to.

If this policy remains in place, the longer-term impact could be more visible:

Seattle may see flatter growth in home prices and rents, especially in the higher tiers of the market.

Neighborhoods popular with international professionals (Capitol Hill condos, Eastside new construction, downtown high-rises) may feel the most pressure.

On the flip side, first-time buyer segments and more affordable neighborhoods may be less affected, since their demand is largely local.

Another wildcard: some companies may start moving roles overseas if hiring foreign talent here becomes too costly. If that happens, Seattle could lose a slice of its job growth engine — and housing demand along with it.

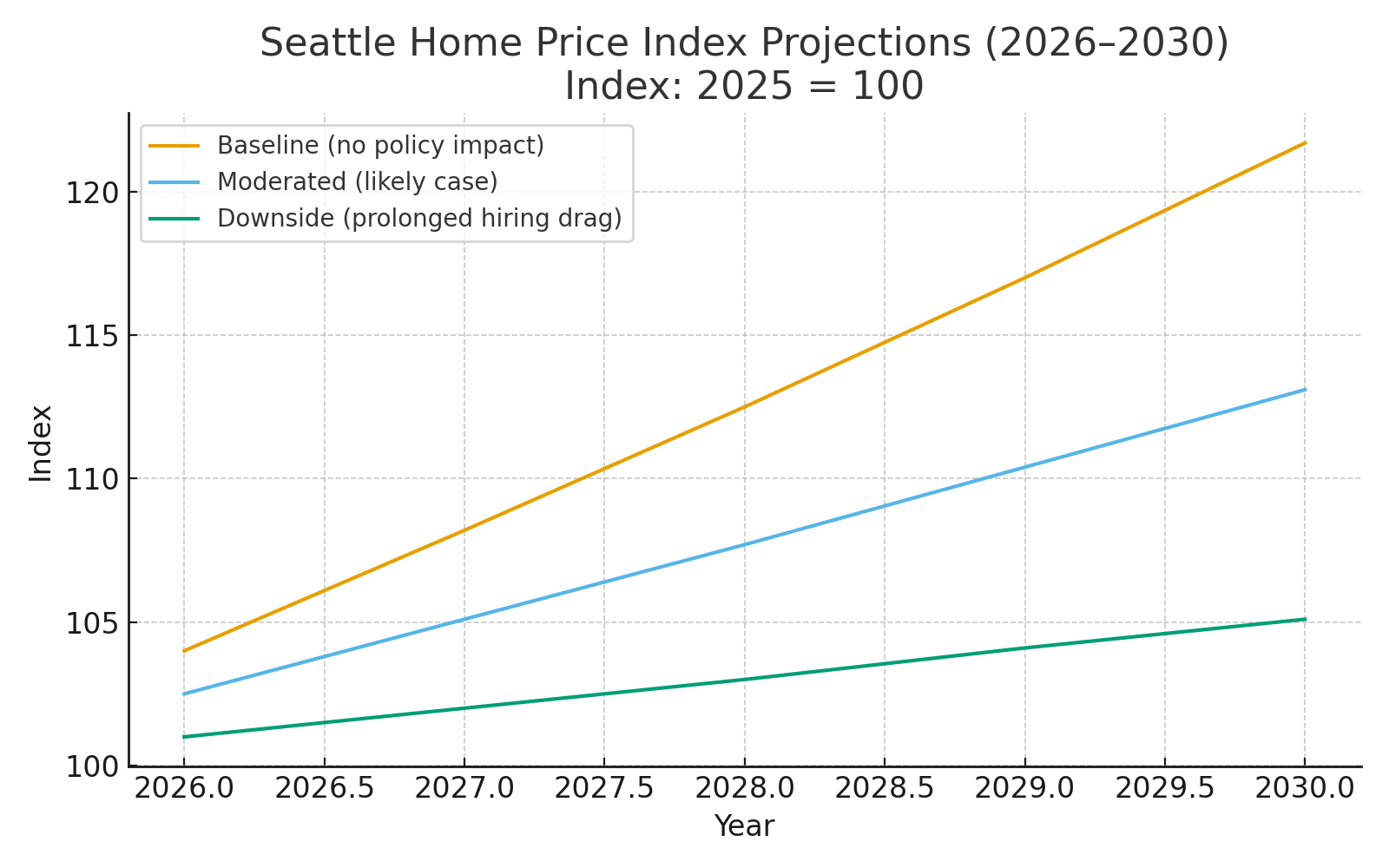

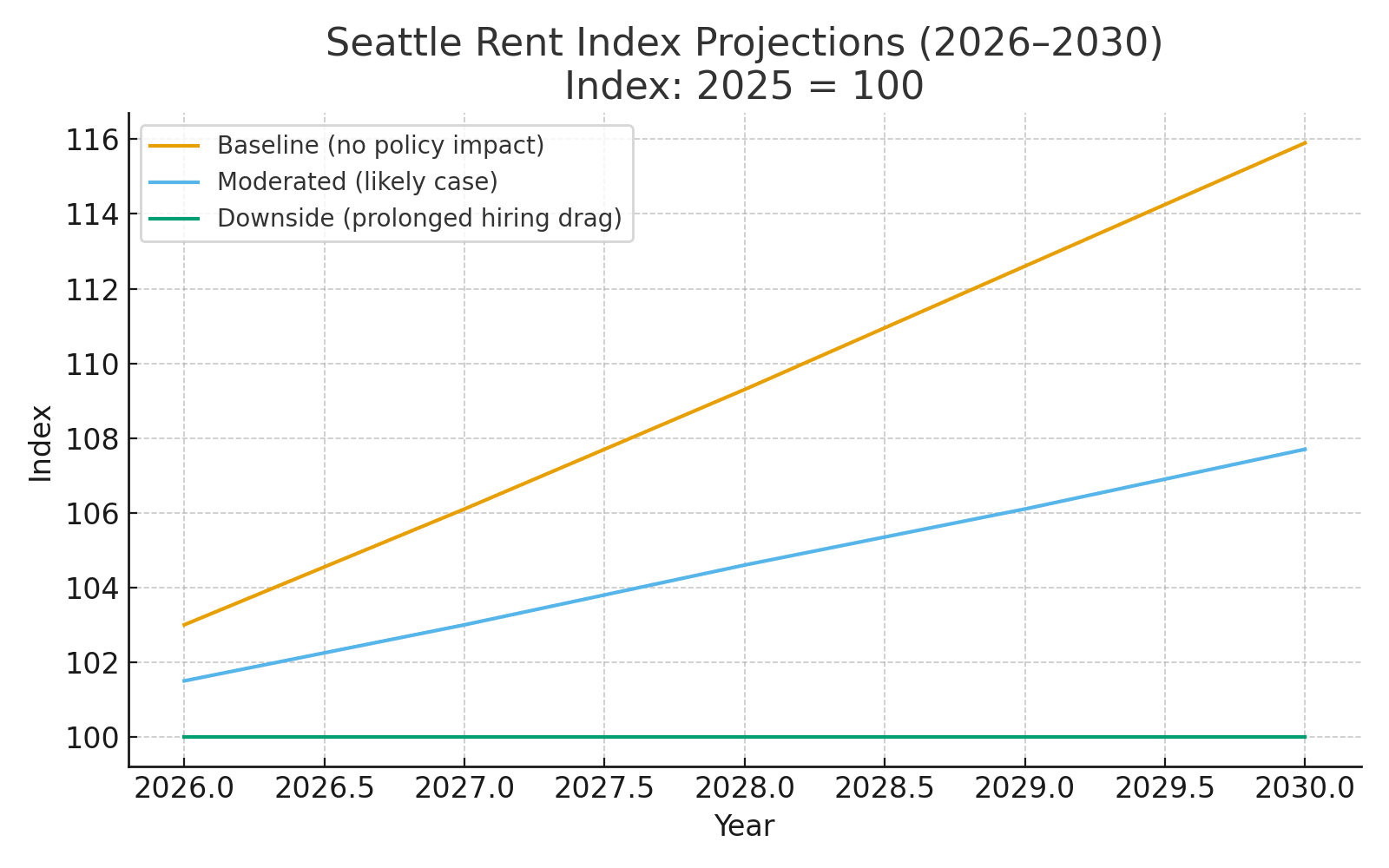

To see how this plays out, we built simple projections for home prices and rents indexed to 2025 = 100.

Assumptions (editable if you want to tweak later):

Baseline (no policy impact): home prices +4%/yr; rents +3%/yr

Moderated / likely case (policy dampens new hiring & in-migration): home prices +2.5%/yr; rents +1.5%/yr

Downside (sustained hiring drag/offshoring): home prices +1%/yr; rents 0%/yr

Seattle Home Price Index Projections (2026–2030)

Seattle Home Price Index Projections (2026–2030) Seattle Rent Index Projections (2026–2030)

Seattle Rent Index Projections (2026–2030)📑 Download the raw data as CSV

It’s important to remember that immigration isn’t the only driver of Seattle housing. Even with fewer new H-1B visas:

Renewals aren’t touched — meaning thousands of existing workers will continue to buy, rent, and move up in the market.

Domestic migration (people moving here from other U.S. cities) may still keep demand high.

Tight supply and zoning restrictions will continue to put a floor under home values.

In other words, this policy may be more of a “growth dampener” than a crash trigger.

The Trump $100,000 H-1B Fee Act adds a new layer of uncertainty to Seattle’s housing future. Over the next five years, it could mean slower appreciation, softer rent growth in high-end segments, and a bit more breathing room for buyers who’ve been outbid in the past.

But in a city with a limited housing supply and a still-booming tech sector, don’t expect this to unravel Seattle’s housing story. Instead, think of it as one more factor shaping a market that’s already juggling interest rates, inflation, zoning reforms, and shifting work patterns.

Seattle real estate has always been about navigating change — and this is just the latest curveball.

👉 Want to talk strategy for your own buying or selling plans in light of these changes? Let’s chat — our team keeps a close pulse on how policies, jobs, and housing data intersect so you can make confident moves.

In everything that I do as your REALTOR®, I have one guiding principle in mind: To make certain that your home-buying or selling experience is a happy, successful, wonderful life experience! We build trust and security with our clients using knowledge and transparency.